Why offer an MTA

Support, retain, and attract employees with an MTA

A Medical Travel Account (MTA) is an employer-sponsored, post-tax account that covers travel expenses to receive qualified medical care, otherwise unavailable within a reasonable distance from the employee’s primary residence. MTAs help maintain or extend access to services covered under your health plans, among other advantages.

A better benefits package

Attract and retain employees or advance the goals of DE&I initiatives with benefits for a variety of health plans and medical needs.

Does not compromise eligibility

MTAs are compatible with HSAs, FSAs, HRAs, and others, so offering them doesn’t compromise eligibility for most other benefits.

Why Lively

Loved by account holders, trusted by employers

The Lively customer experience raises the bar in the benefit solutions industry, with Lively leading the charge in:

Exceptional customer support

Every employer is assigned to a Customer Success team, while employees have access to a top-rated Member Support team.

Innovative and proprietary technology

Built in-house and thoughtfully designed to be easy-to-use, dependable, and to personalize employer experiences.

Taking the burden off employers

Robust education and resources, crafted to continuously drive usage for employees and take the burden off administrators.

Why Lively

Loved by account holders, trusted by employers

The Lively customer experience raises the bar in the benefit solutions industry, with Lively leading the charge in:

Features & Benefits

Benefit from a more flexible Medical Travel Account

According to a report published by Mercer, 44% of employers offer medical travel benefits, or will in 2023. Lean on Lively to offer an MTA thoughtfully designed to offer your employees more flexibility, while putting employers in control.

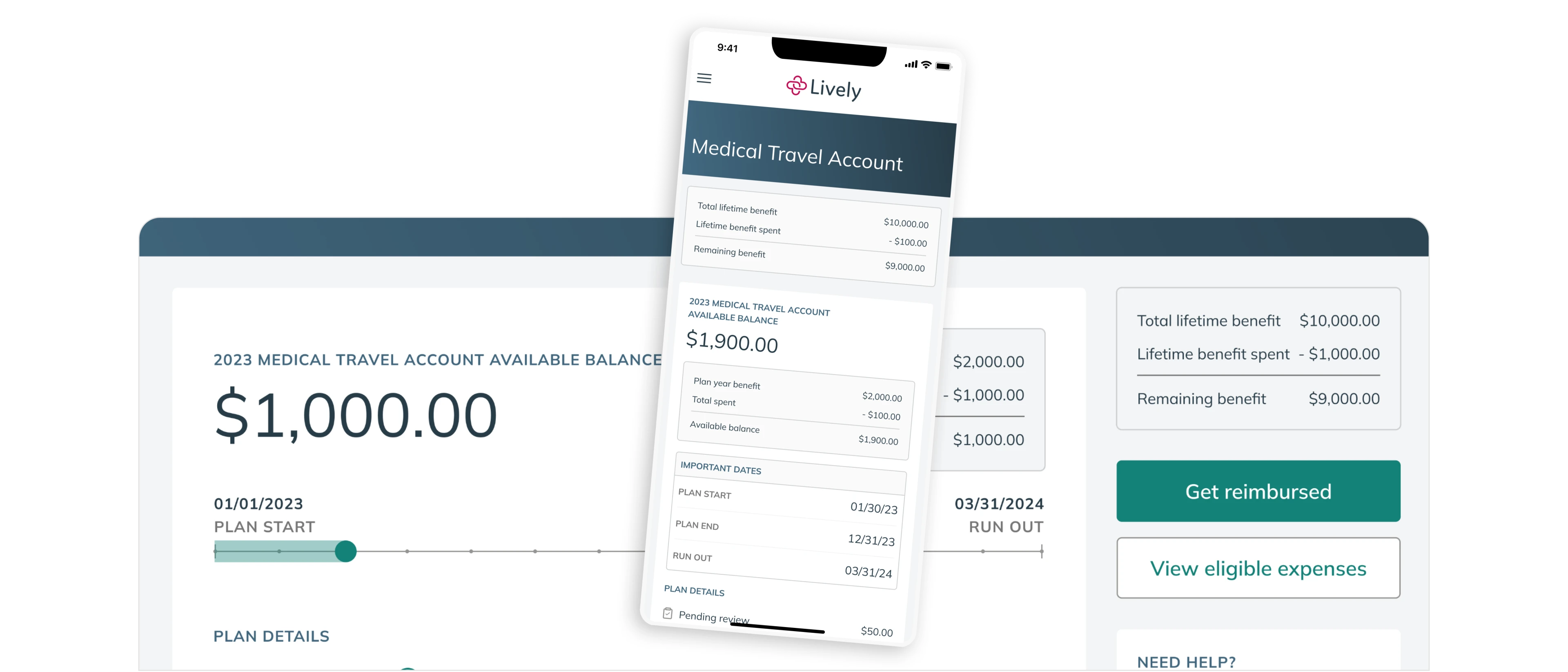

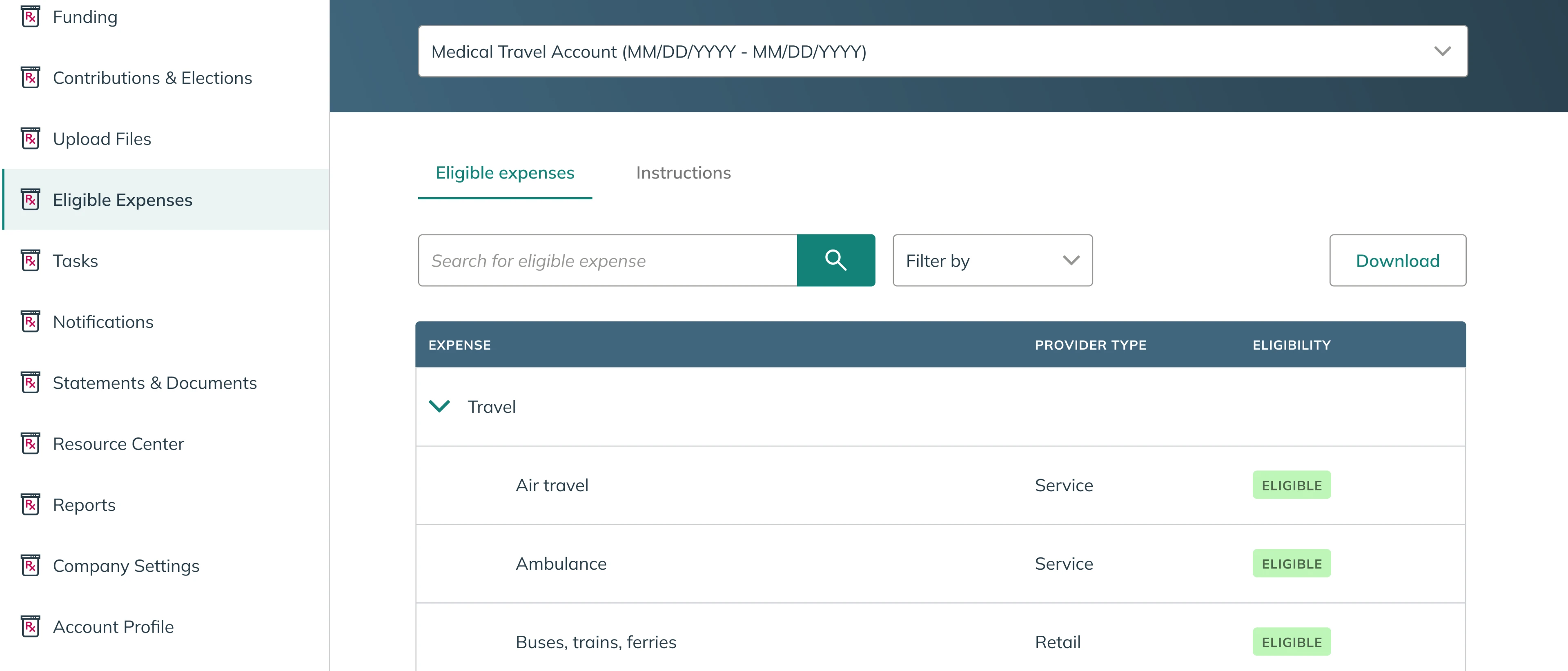

Easy for you to administer, easy for employees to adopt

Manage participant enrollment, contributions, usage, and more on Lively’s intuitive platform.

Get year-round admin support and hands-on onboarding help from your Customer Success team.

Trust our proven track record of reducing employee inquiries and taking more tasks off your plate.

Convenient payments and reimbursements

Employees enjoy a simple, paperless claims verification process with fast reimbursements and helpful guidance. Approved funds are reimbursed in 1- 2 business days.

FOR BUSINESS

Contact our sales team

Simply fill out the form and we'll be in touch within one business day.

By submitting this form, you agree to Lively’s Privacy Policy and consent to receive email communications.

Frequently Asked Questions (FAQ)

How do MTAs work?

The specifics of how your MTA benefit works will vary per your employer’s MTA plan design and the MTA provider, if there is one. Your employer will determine how much money will be allocated to your MTA as well as when the funds will be available. Upon being enrolled in your employer-sponsored MTA, you may request a reimbursement from your MTA once you incur an eligible expense. You will first pay for the eligible expense out-of-pocket, then submit a request for reimbursement through your MTA account online.

Are MTAs taxable?

Yes, the total reimbursed amount for a plan term is considered taxable income per IRS guidelines.

Why should employers offer an MTA?

Employers may offer an MTA benefit to offer a more diverse benefits package to retain and attract employees. Unlike many other ancillary benefits, MTAs do not need to be paired with a specific type of health insurance to qualify. This means MTAs can be used alongside any health insurance, making it a flexible option for varying employee needs. In many instances, MTAs are leveraged to advance Diversity, Equity, and Inclusion (DEI) goals, as it extends coverage for medical travel services to make it easier for employees to access needed care. For example, pregnant people seeking safe reproductive health care or those living in rural areas with a scarcity of specialists could benefit from participating in an MTA.

Can Medical Travel Accounts be customized?

One of the benefits of MTAs for employers is that it is a highly customizable plan. Employers can decide which employees are eligible, how much to allocate to the MTA benefit, when to make the funds available, how long the MTA plan term will last, and more. It’s important to work with an MTA provider that can guide benefit administrators through best practices for how to configure your MTA benefit.