Value of an HSA

Save money and enhance your benefits package

A Health Savings Account (HSA) is a tax-advantaged, personal savings account that covers eligible healthcare expenses. It enhances benefits packages for recruitment and retention, while cutting costs on taxes and insurance premiums for employees and employers. Offer employees flexibility and savings:

Boosts HDHP adoption

Designed to pair with High Deductible Health Plans (HDHPs), which can reduce overall healthcare costs.

Saves your business money

Employers save on payroll taxes and health insurance costs, as well as reduce the business’ taxable income.

Why Lively

Offer employees a frustration-free experience

From unrivaled customer service to account holder education, we go the extra mile to make your life easier and keep employees happy.

Exceptional customer support

Every employer is assigned to a Customer Success team, while employees have access to a top-rated Member Support team.

Innovative and proprietary technology

Built in-house and thoughtfully designed to be easy-to-use, dependable, and to personalize employer experiences.

Taking the burden off employers

Robust education and resources, crafted to continuously drive usage for employees and take the burden off administrators.

Why Lively

Offer employees a frustration-free experience

From unrivaled customer service to account holder education, we go the extra mile to make your life easier and keep employees happy.

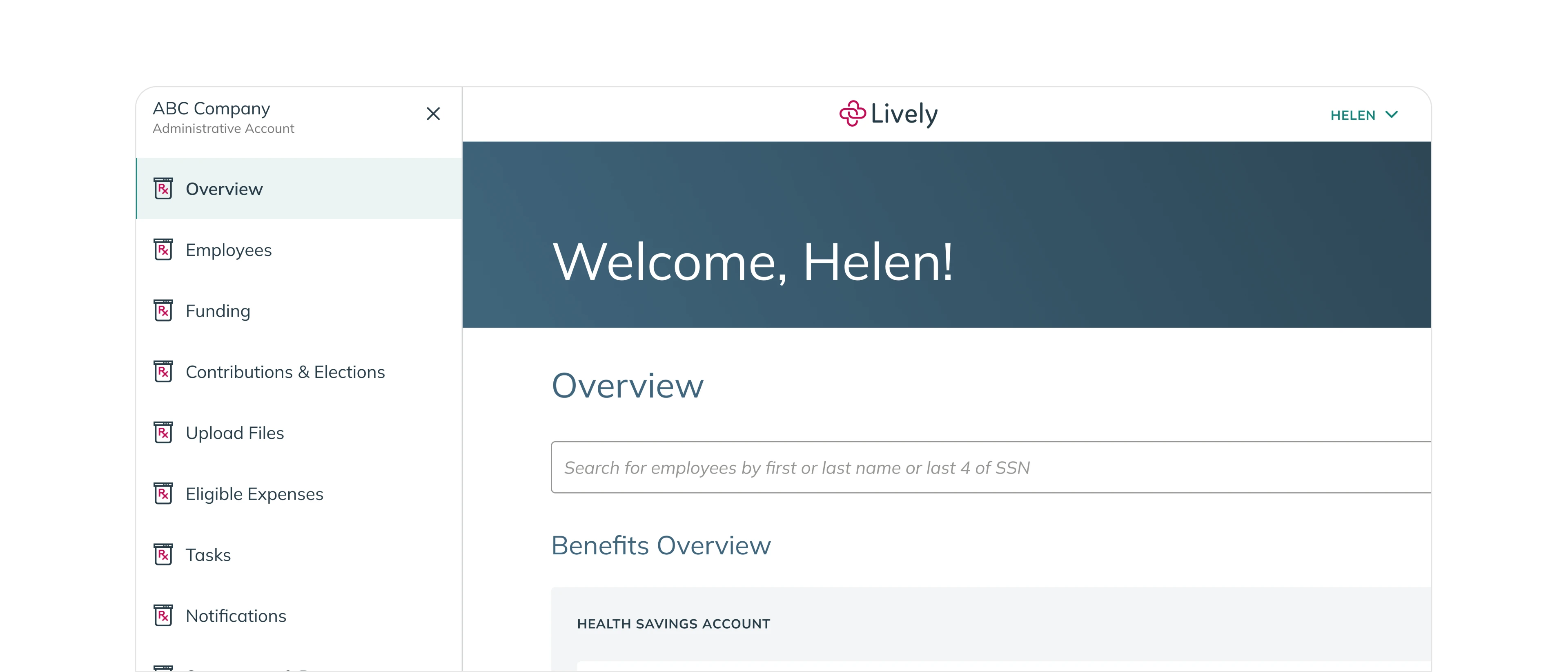

Key features

Make HSA administration effortless

The best-in-class HSA with unrivaled user experiences

Confidently offer employees a top-rated HSA, with support and tools to increase adoption at every step.

Smart features to simplify admin tasks

Timely notifications and reminders help HR admins stay on top of their day-to-day. Features such as Secure File Transfer (SFTP), Starter Penny, and Employer Match enable HR teams to take care of their people with ease. Plus, robust reports enable informed program decisions.

Ongoing employee engagement, education, and support

We take the burden off of admins by continuously engaging employees with a wide range of resources and tools to help them understand how to use their HSA accounts. And employees can easily get in touch with member support experts who always go the extra mile via phone, email, or chat.

Employee HSA dashboard demo

User-friendly design and robust smart features

Employees can effortlessly adopt the Lively HSA and stay on top of their accounts with simple user experiences.

Smart features for account holders easily maximize HSA usage, including Expenses Scout, Claim Sync, and Deductible Tracker.

Powerful, dependable platform and mobile app delivers a streamlined, intuitive experience.

Personalized investing with two-industry leading solutions tailored to your personal financial goals.

Raise your expectations

4 times better

Customer satisfaction is more than 3 times higher than the industry average.*

30 seconds or less

We don't keep you waiting. Over 95% of account holder calls are answered in less than 30 seconds.

$1 billion +

Over $1 billion in HSA assets on the Lively platform.

*Based on Net Promoter Score (NPS). NPS is a widely used metric that measures customer satisfaction. Lively's NPS score is three times higher than the industry average of 16-34.

Raise your expectations

*Based on Net Promoter Score (NPS). NPS is a widely used metric that measures customer satisfaction. Lively's NPS score is three times higher than the industry average of 16-34.

Transparent pricing

One simple fee

For businesses: Lively's standard pricing is $2.95 per enrolled employee per month, subject to a monthly minimum of $50.

For individuals: Opening and holding a Lively account is free for individuals with non employer-sponsored HSAs. If an employee leaves a company, their account is converted to an individual HSA at no cost.

Support for all size groups

Regardless of the employer group size, they have access to a dedicated customer success team to ensure they get the support they need when they need it.

Customer stories

Ease of access. A great account management team. And having employees be able to easily access their money when they need it.

Customer stories

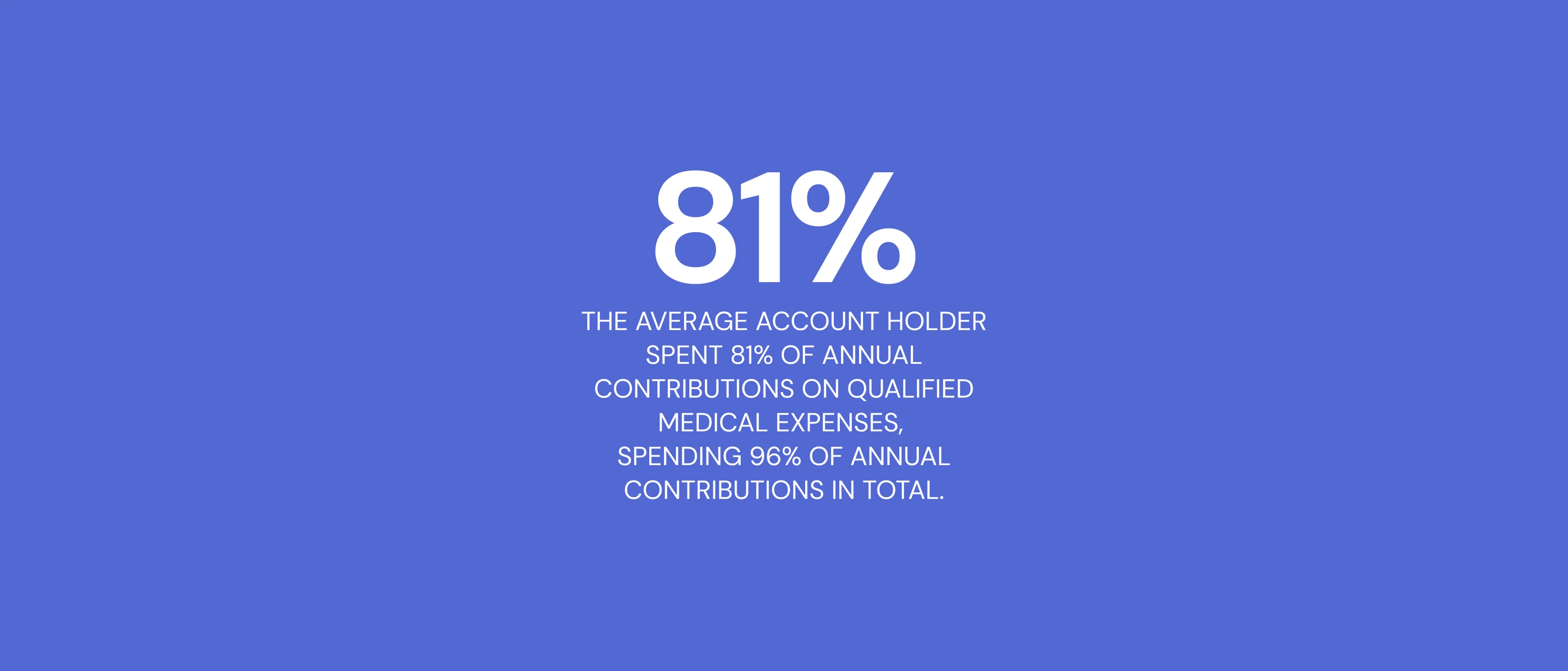

Report

79% of HR leaders say HSAs are effective in attracting and retaining employees

Get insight from 250 HR leaders on how to support Health Savings Account education and adoption and build a comprehensive, modern, flexible benefits package.

FOR BUSINESS

Contact our sales team

Simply fill out the form and we'll be in touch within one business day.

By submitting this form, you agree to Lively’s Privacy Policy and consent to receive email communications.

Frequently Asked Questions (FAQs)

Why should employers offer an HSA?

In addition to being a popular benefit that enhances employee recruitment and retention, employer contributions to employees’ HSAs count as a tax-deductible business expense. When employee contributions are dedicated pre-tax, it reduces the business’s payroll taxes per employee, per paycheck. In addition, because they are paired with high deductible health plans, HSAs help organizations save on healthcare costs due to the lower premium rates of HDHPs.

Can an employer offer both an HSA and FSA?

Yes, an employer may offer both an HSA and FSA to employees if they also offer a qualifying High Deductible Health Plan (HDHP). Employees can choose between these two benefits. In order to participate in the HSA, the employee must also be enrolled in an HDHP. If the employee wishes to participate in the FSA, they can choose whichever health insurance plan that works for them. If the employee chooses the HSA/HDHP combination, they can still participate in a Limited Purpose FSA or Dependent Care FSA.

What should employers and brokers look for in an HSA provider?

A best-in-class HSA provider should offer top-rated, responsive, expert customer service for both HR administrators and employees, streamlined technology that makes onboarding and ongoing account administration easy, a top-rated mobile app, and timely resources and education to ensure employees get the most out of their benefits.

Can you bundle HSAs with other flexible benefits?

Yes. HSAs can be paired with the following tax-advantaged accounts: Post-Deductible Health Reimbursement Arrangements, Limited Purpose FSAs (which cover dental and vision), and Dependent Care FSAs. HSAs They can also be paired with post-tax health and wellness accounts such as Lifestyle Spending Accounts and Medical Travel Accounts.