Why Lively

Best-in-class solutions, unparalleled support

According to WEX, there has been a 32% increase in qualified beneficiaries year-over-year, despite the introduction of the Affordable Care Act (ACA). With Lively COBRA & Direct Bill, employer administrators can count on industry-leading technology and year-round, expert support to minimize compliance risks and reduce administrative headaches.

Expert guidance at every step

Every employer has access to Lively’s Customer Success team as their main point of contact, and guidance from COBRA experts, to help walk them through a successful implementation.

Flexibility with your benefits package

Lively’s employee benefits solutions deliver innovation and flexibility at scale. Whether you’re considering a standalone COBRA solution, or looking to combine it with other benefits including Direct Bill, HSA, FSA, HRA, MTA, and LSA — we’ve got you covered.

Features & Benefits

Take the guesswork out of COBRA administration

Both employers and participants can proceed with confidence when using Lively COBRA, a federally compliant solution that streamlines the process from end-to-end.

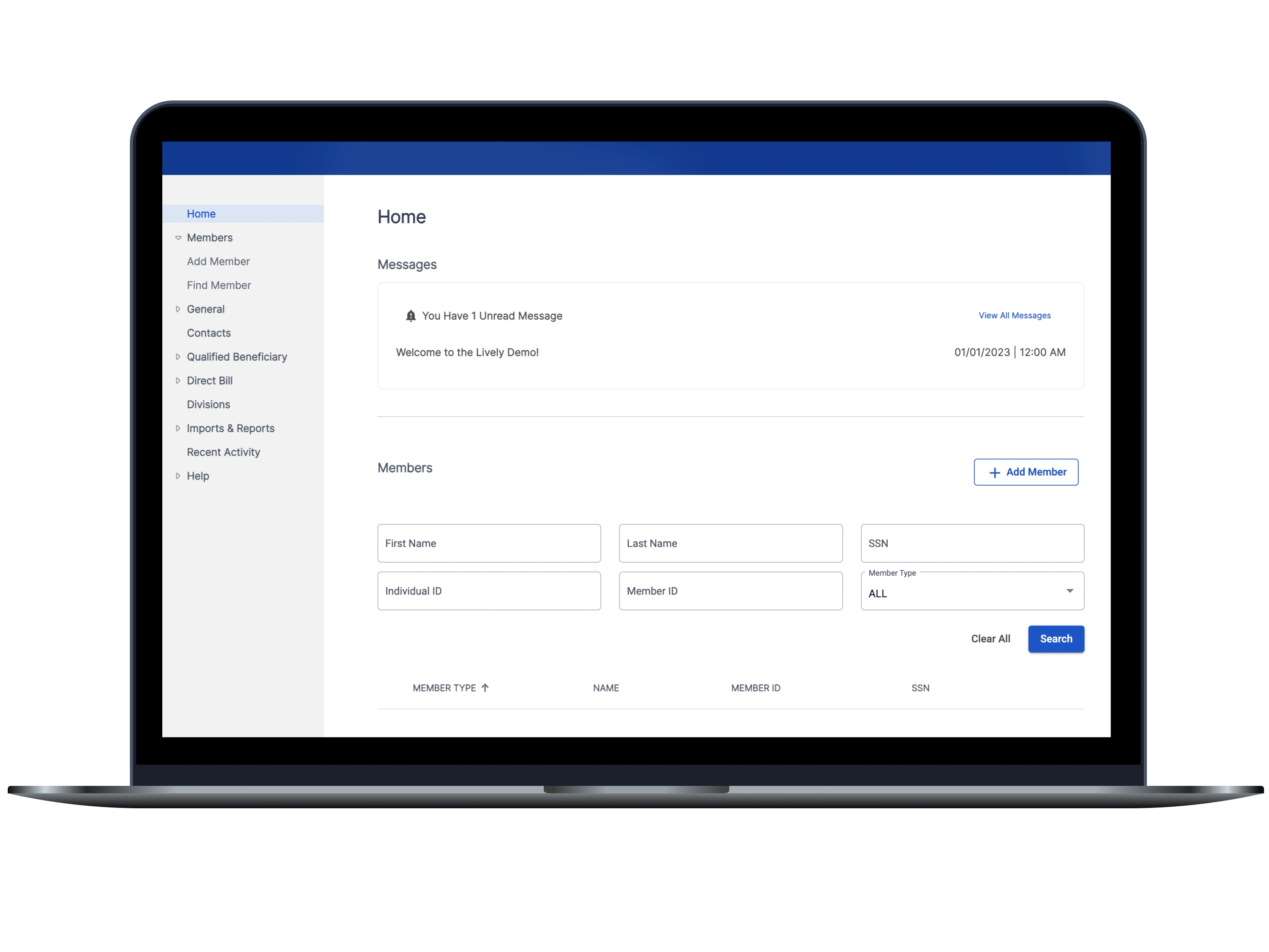

Real-time reporting at your fingertips

Stay on top of your COBRA & Direct Bill administration, with reports easily accessible directly from the Lively COBRA dashboard. Examples of standard reports include details on payments, participants, email notifications, and generated mail notices.

Cohesive, easy-to-use dashboard

Employers have access to the Lively COBRA dashboard experience whenever they need it, 24/7. The COBRA dashboard also connects seamlessly with other Lively benefits through Single Sign-On — which means employers can easily access the administrator dashboard for all of their Lively benefits from one location.

Lively Direct Bill when you need it

Safe and easy payment collection

Easily collect payments from participants who maintain health coverage for a period while not on payroll, such as those retiring or on leave, with the Lively Direct Bill add-on.

Automatic premium remittance

Streamline the process of health insurance plan premium collection and remittance.

Convenient mobile app access

Participants can set up one-time payments or recurring payments, and keep track of payment history and upcoming payment schedules, no matter where they are.

FOR BUSINESS

Contact our sales team

Simply fill out the form and we'll be in touch within one business day.

By submitting this form, you agree to Lively’s Privacy Policy and consent to receive email communications.

Frequently Asked Questions (FAQ)

How do employees sign up for COBRA?

When an employee loses coverage due to a qualifying event, this is the step-by-step process for signing up for COBRA:

Within 30 days an employer must notify the health plan of said qualifying event.

The health plan has 14 days to send the former employee what’s called an election notice to restart their workplace health insurance.

They then have 60 days to choose to re-enroll in their former employer’s group health plan. Once they re-enrolled, they (or the employer if their COBRA coverage is being subsidized) have 45 days to pay the first premium.

Coverage begins once the insurance company has received the first premium payment and will be retroactive, covering any medical expenses incurred before the COBRA plan began.

All the former employees’ health plan details including co-pays, co-insurance and health cards will remain the same.

Is COBRA insurance worth it?

While COBRA can be expensive, depending on both the cost of the plan and the amount of regular medical care and/or prescriptions one takes, it could be less expensive overall than purchasing a plan in the private market. The main reasons that people elect COBRA are: they already met their deductible and have upcoming healthcare needs they don't want to pay out of pocket for; they want to keep their current doctor or network; employees don't want a lapse in coverage between the time the time they lose their job and start other coverage; employers offer subsidies to COBRA coverage as part of their severance agreement.

Can I have an HSA with COBRA?

If a former-employee had an HSA with their previous employer, they still have access to their contributions, because HSAs are owned by the account holder. If former employees had an HSA-eligible health plan they continue through COBRA, they can continue to contribute to their HSA unless they become covered by a healthcare FSA. Their contributions lose their tax-exempt status but they gain the ability to pay for their COBRA premiums with their HSA.

What does COBRA cover?

COBRA covers all qualifying group health insurance plans (e.g. PPOs, HDHPs, HMOs) for private sector companies. It also covers vision, dental, pharmacy plans, many FSA plans, some HRAs, and more. Since COBRA isn’t a new health insurance plan, but is instead the system through which employees maintain access to their previous employer-sponsored group plan, their coverage will remain the same. The only thing that changes is the cost, as plan-holders are responsible for paying for 100% of the premium cost. Plus the requisite co-pays, co-insurance and other out-of-pocket costs.